andrenader.substack.com/p/my-investment-rebalancing-process

Preview meta tags from the andrenader.substack.com website.

Linked Hostnames

10- 14 links tosubstackcdn.com

- 12 links tosubstack.com

- 4 links toandrenader.substack.com

- 3 links towww.faangfire.com

- 2 links toearlyretirementnow.com

- 2 links tofrec.com

- 1 link tocorporate.vanguard.com

- 1 link toinstitutional.vanguard.com

Thumbnail

Search Engine Appearance

My Investment Rebalancing Process

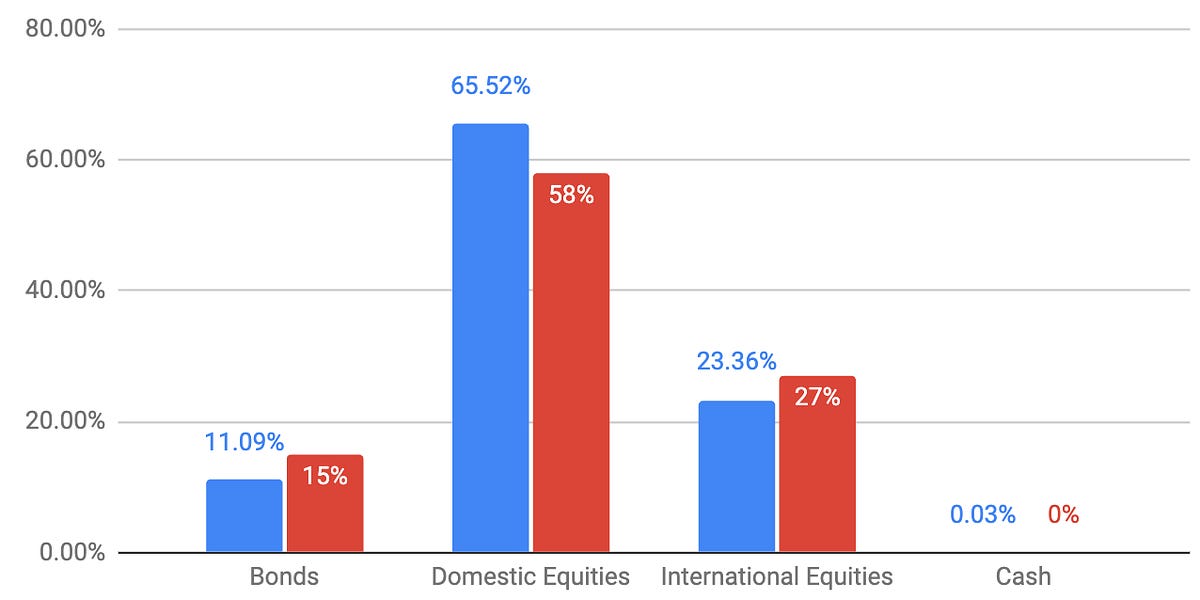

One reason to hold different asset classes is that they are not perfectly correlated. Over time, if you don’t rebalance your portfolio, your asset allocation will naturally drift away from your target allocation. This drift could leave you with a much riskier portfolio than you originally intended.

Bing

My Investment Rebalancing Process

One reason to hold different asset classes is that they are not perfectly correlated. Over time, if you don’t rebalance your portfolio, your asset allocation will naturally drift away from your target allocation. This drift could leave you with a much riskier portfolio than you originally intended.

DuckDuckGo

My Investment Rebalancing Process

One reason to hold different asset classes is that they are not perfectly correlated. Over time, if you don’t rebalance your portfolio, your asset allocation will naturally drift away from your target allocation. This drift could leave you with a much riskier portfolio than you originally intended.

General Meta Tags

35- titleMy Investment Rebalancing Process - by Andre Nader

- title

- title

- title

- title

Open Graph Meta Tags

5- og:urlhttps://www.faangfire.com/p/my-investment-rebalancing-process

- og:typearticle

- og:titleMy Investment Rebalancing Process

- og:descriptionOne reason to hold different asset classes is that they are not perfectly correlated. Over time, if you don’t rebalance your portfolio, your asset allocation will naturally drift away from your target allocation. This drift could leave you with a much riskier portfolio than you originally intended.

- og:imagehttps://substackcdn.com/image/fetch/$s_!jYj4!,w_1200,h_600,c_fill,f_jpg,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F87aee101-c844-4a8c-9206-6459c3bf5bec_1276x758.png

Twitter Meta Tags

4- twitter:titleMy Investment Rebalancing Process

- twitter:descriptionOne reason to hold different asset classes is that they are not perfectly correlated. Over time, if you don’t rebalance your portfolio, your asset allocation will naturally drift away from your target allocation. This drift could leave you with a much riskier portfolio than you originally intended.

- twitter:imagehttps://substackcdn.com/image/fetch/$s_!vuBn!,f_auto,q_auto:best,fl_progressive:steep/https%3A%2F%2Fandrenader.substack.com%2Fapi%2Fv1%2Fpost_preview%2F147455413%2Ftwitter.jpg%3Fversion%3D4

- twitter:cardsummary_large_image

Link Tags

30- alternate/feed

- apple-touch-iconhttps://substackcdn.com/image/fetch/$s_!Nxk4!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2f8ebf47-fe8b-4de9-a511-f5ccb7e82371%2Fapple-touch-icon-57x57.png

- apple-touch-iconhttps://substackcdn.com/image/fetch/$s_!0SZC!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2f8ebf47-fe8b-4de9-a511-f5ccb7e82371%2Fapple-touch-icon-60x60.png

- apple-touch-iconhttps://substackcdn.com/image/fetch/$s_!bIZk!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2f8ebf47-fe8b-4de9-a511-f5ccb7e82371%2Fapple-touch-icon-72x72.png

- apple-touch-iconhttps://substackcdn.com/image/fetch/$s_!4W7_!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2f8ebf47-fe8b-4de9-a511-f5ccb7e82371%2Fapple-touch-icon-76x76.png

Links

41- https://andrenader.substack.com

- https://andrenader.substack.com/i/119553664/primer-on-wash-sales-and-rsus

- https://andrenader.substack.com/p/direct-indexing-tax-loss-harvesting

- https://andrenader.substack.com/p/my-asset-allocation-and-asset-location

- https://corporate.vanguard.com/content/dam/corp/research/pdf/rational_rebalancing_analytical_approach_to_multiasset_portfolio_rebalancing.pdf